Life insurance is a critical financial product that provides security and peace of mind for individuals and their families. It offers financial protection in the event of the policyholder's death, ensuring that loved ones are taken care of. Whether you're just starting to explore life insurance options or looking to expand your knowledge, this guide will provide all the essential information you need.

Understanding life insurance is not just about buying a policy; it's about securing your family's future. With various types of policies, terms, and conditions, it's essential to make informed decisions. This article will walk you through everything from the basics to advanced strategies, ensuring you have a clear understanding of how life insurance works.

Life insurance is not a one-size-fits-all solution. Each policy is tailored to meet specific needs, and understanding the nuances can make a significant difference. By the end of this guide, you'll be equipped with the knowledge to choose the right policy for your unique situation.

Read also:Al Roker Salary A Comprehensive Look At The Weathermans Earnings And Career

Table of Contents

- What is Life Insurance?

- Types of Life Insurance

- How Life Insurance Works

- Benefits of Life Insurance

- Factors Affecting Life Insurance Premiums

- How to Choose the Right Policy

- Common Mistakes to Avoid

- Tax Implications of Life Insurance

- Life Insurance and Estate Planning

- Frequently Asked Questions

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company, where the insurer agrees to pay a designated beneficiary a sum of money upon the policyholder's death. In exchange, the policyholder pays regular premiums to maintain the policy's coverage. This financial protection is designed to help beneficiaries cover expenses, replace lost income, and secure their financial future.

Why is Life Insurance Important?

- Provides financial security for loved ones

- Helps cover funeral and burial costs

- Replaces lost income in case of the policyholder's death

- Assists with paying off debts and mortgages

According to the Insurance Information Institute, approximately 60% of U.S. households have life insurance coverage, highlighting its importance in modern financial planning.

Types of Life Insurance

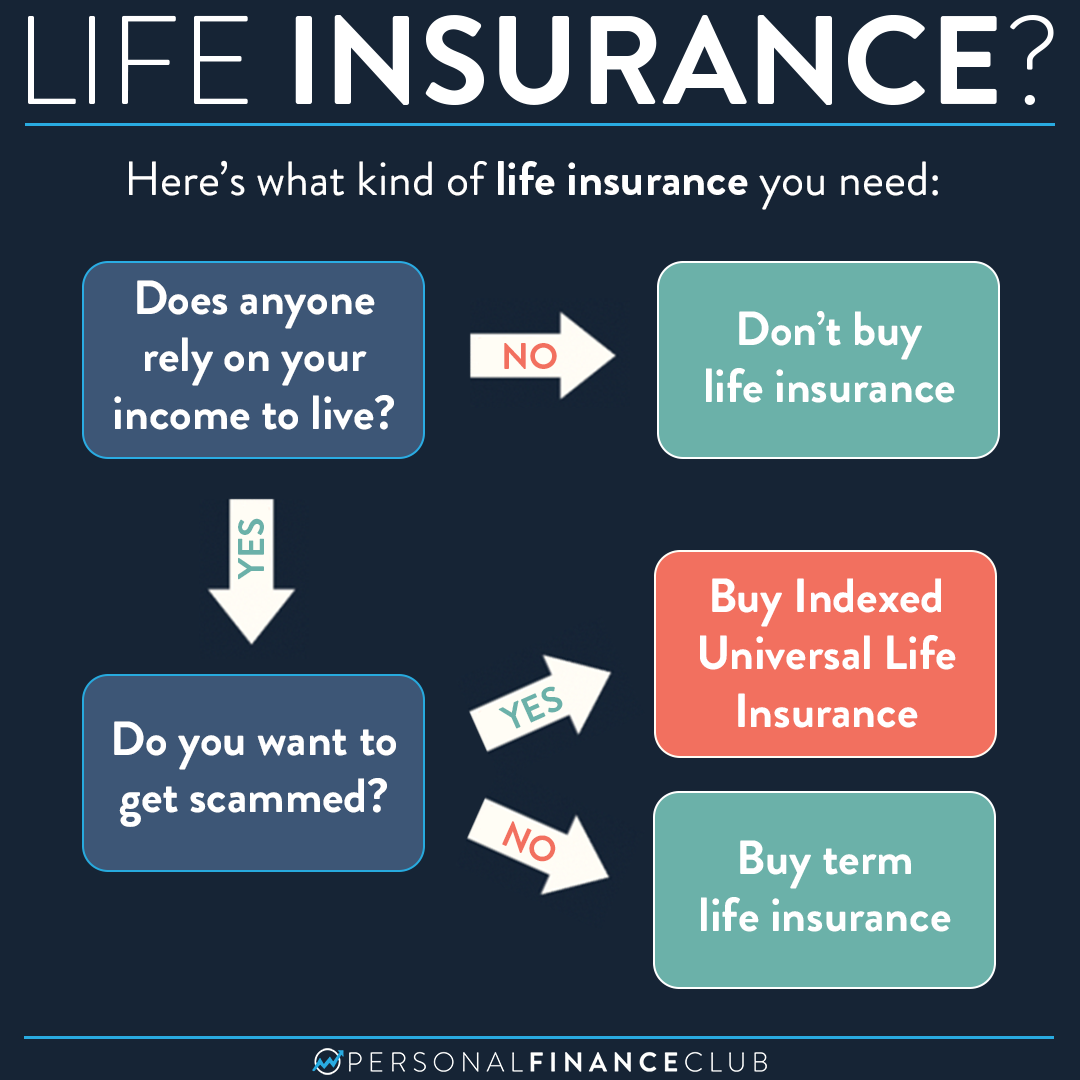

There are several types of life insurance policies available, each designed to meet different needs and preferences. The two primary categories are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiary receives the death benefit. However, if the policyholder outlives the term, the coverage ends, and no payout is made.

Permanent Life Insurance

Permanent life insurance offers lifelong coverage and includes a cash value component that grows over time. Common types of permanent life insurance include whole life, universal life, and variable life insurance.

How Life Insurance Works

Life insurance operates on the principle of risk pooling. Insurance companies assess the risk of insuring an individual based on factors such as age, health, lifestyle, and occupation. Policyholders pay premiums, which are used to fund the death benefits and cover administrative costs.

Read also:Ofilmywap A Comprehensive Guide To The Popular Movie Streaming Platform

Key Components of a Life Insurance Policy

- Premium: The amount paid regularly to maintain coverage.

- Death Benefit: The sum of money paid to the beneficiary upon the policyholder's death.

- Policyholder: The individual who purchases and maintains the policy.

- Beneficiary: The person or entity designated to receive the death benefit.

Benefits of Life Insurance

Life insurance offers numerous benefits beyond financial protection. Here are some key advantages:

- Provides peace of mind knowing your loved ones are taken care of.

- Helps pay off debts, such as mortgages and credit card balances.

- Can be used as part of a comprehensive estate planning strategy.

- Offers potential tax advantages, depending on the type of policy.

Research by LIMRA shows that individuals with life insurance coverage are more likely to have a well-planned financial future compared to those without it.

Factors Affecting Life Insurance Premiums

Several factors influence the cost of life insurance premiums. Understanding these factors can help you make informed decisions when purchasing a policy.

Age and Health

Younger and healthier individuals typically pay lower premiums due to a lower perceived risk. Pre-existing medical conditions or unhealthy lifestyles may increase premiums.

Lifestyle and Occupation

Risky hobbies, such as skydiving or motor racing, or hazardous occupations, like construction work, can result in higher premiums. Conversely, safe lifestyles and stable jobs may lead to more affordable rates.

How to Choose the Right Policy

Selecting the right life insurance policy involves evaluating your needs, budget, and future goals. Here are some steps to help you make the best choice:

- Determine the amount of coverage you need based on your financial obligations and family's needs.

- Decide between term or permanent life insurance based on your long-term goals.

- Compare quotes from multiple providers to ensure you get the best rates.

- Review the policy's terms and conditions carefully before making a purchase.

Common Mistakes to Avoid

Making the wrong decisions when purchasing life insurance can have significant consequences. Here are some common mistakes to avoid:

- Underestimating the amount of coverage needed.

- Not naming a beneficiary or failing to update beneficiary information.

- Choosing the wrong type of policy for your needs.

- Ignoring the importance of regular premium payments.

Tax Implications of Life Insurance

Life insurance policies can have various tax implications, depending on the type of policy and how it's used. Generally, death benefits are tax-free to beneficiaries. However, certain situations, such as surrendering a policy for its cash value, may result in taxable income.

Tax Advantages of Permanent Life Insurance

Permanent life insurance policies often offer tax-deferred growth on the cash value component, allowing policyholders to build wealth over time without immediate tax consequences.

Life Insurance and Estate Planning

Life insurance plays a crucial role in estate planning by providing liquidity to cover estate taxes and other expenses. It can also be used to transfer wealth to heirs or charitable organizations while minimizing tax liabilities.

Strategies for Incorporating Life Insurance in Estate Planning

- Set up an irrevocable life insurance trust (ILIT) to remove the policy from the taxable estate.

- Use life insurance proceeds to pay estate taxes and avoid liquidating assets.

- Designate charitable organizations as beneficiaries to support causes you care about.

Frequently Asked Questions

What Happens if I Miss a Premium Payment?

Missing a premium payment may result in the policy lapsing, depending on the grace period provided by the insurer. Some policies offer reinstatement options, but additional fees or underwriting may be required.

Can I Change My Beneficiary?

Yes, most policies allow policyholders to change beneficiaries at any time. It's important to keep beneficiary information up to date to ensure the death benefit goes to the intended recipient.

Is Life Insurance Necessary for Everyone?

While life insurance is not mandatory, it's highly recommended for individuals with dependents or significant financial obligations. Single individuals without dependents may not need coverage unless they have specific estate planning goals.

Conclusion

Life insurance is a vital component of financial planning, offering peace of mind and security for individuals and their families. By understanding the different types of policies, factors affecting premiums, and strategies for choosing the right coverage, you can make informed decisions that align with your goals.

We encourage you to take action by reviewing your current coverage, consulting with a financial advisor, or exploring new options. Don't forget to share this article with others who may benefit from the information, and feel free to leave a comment with any questions or insights. Together, let's build a more secure financial future!