Tesla stock price has become one of the most discussed topics in the financial world. As one of the leading electric vehicle manufacturers, Tesla continues to capture the attention of investors and tech enthusiasts alike. Whether you're a seasoned investor or just starting to explore the stock market, understanding Tesla's stock performance is crucial for making informed decisions.

Tesla Inc. has transformed the automotive industry and disrupted traditional markets with its innovative electric vehicles, renewable energy products, and cutting-edge technology. The company's stock price reflects its growth trajectory, market sentiment, and future potential. As Tesla expands its global footprint, its stock price remains a key indicator of the company's success.

In this article, we'll delve into the factors influencing Tesla stock price, historical trends, and expert predictions. By the end, you'll have a clear understanding of how Tesla's stock performs and what drives its value in the market. Let's get started!

Read also:Mark Orchard A Comprehensive Guide To His Life Career And Achievements

Table of Contents

- Introduction to Tesla Stock Price

- Historical Performance of Tesla Stock

- Factors Affecting Tesla Stock Price

- Tesla Stock Market Analysis

- Long-Term Outlook for Tesla Stock

- Investing in Tesla Stock

- Tesla Stock Price Predictions

- Tesla Stock Price vs Competitors

- Risks and Challenges for Tesla Stock

- Conclusion

Introduction to Tesla Stock Price

Tesla's stock price has been a hot topic in the financial world due to its rapid growth and volatile nature. Since its initial public offering (IPO) in 2010, Tesla's stock has experienced significant fluctuations, reflecting both the company's success and challenges.

Why Tesla Stock Matters

Tesla stock price is not just a reflection of the company's financial health; it also represents the broader shift toward sustainable energy and electric vehicles. Investors closely monitor Tesla's stock performance to gauge the future of the automotive industry.

Key Milestones in Tesla Stock History

Several key milestones have influenced Tesla's stock price over the years:

- 2010 IPO at $17 per share

- 2020 stock split, increasing accessibility for retail investors

- Inclusion in the S&P 500 Index

Historical Performance of Tesla Stock

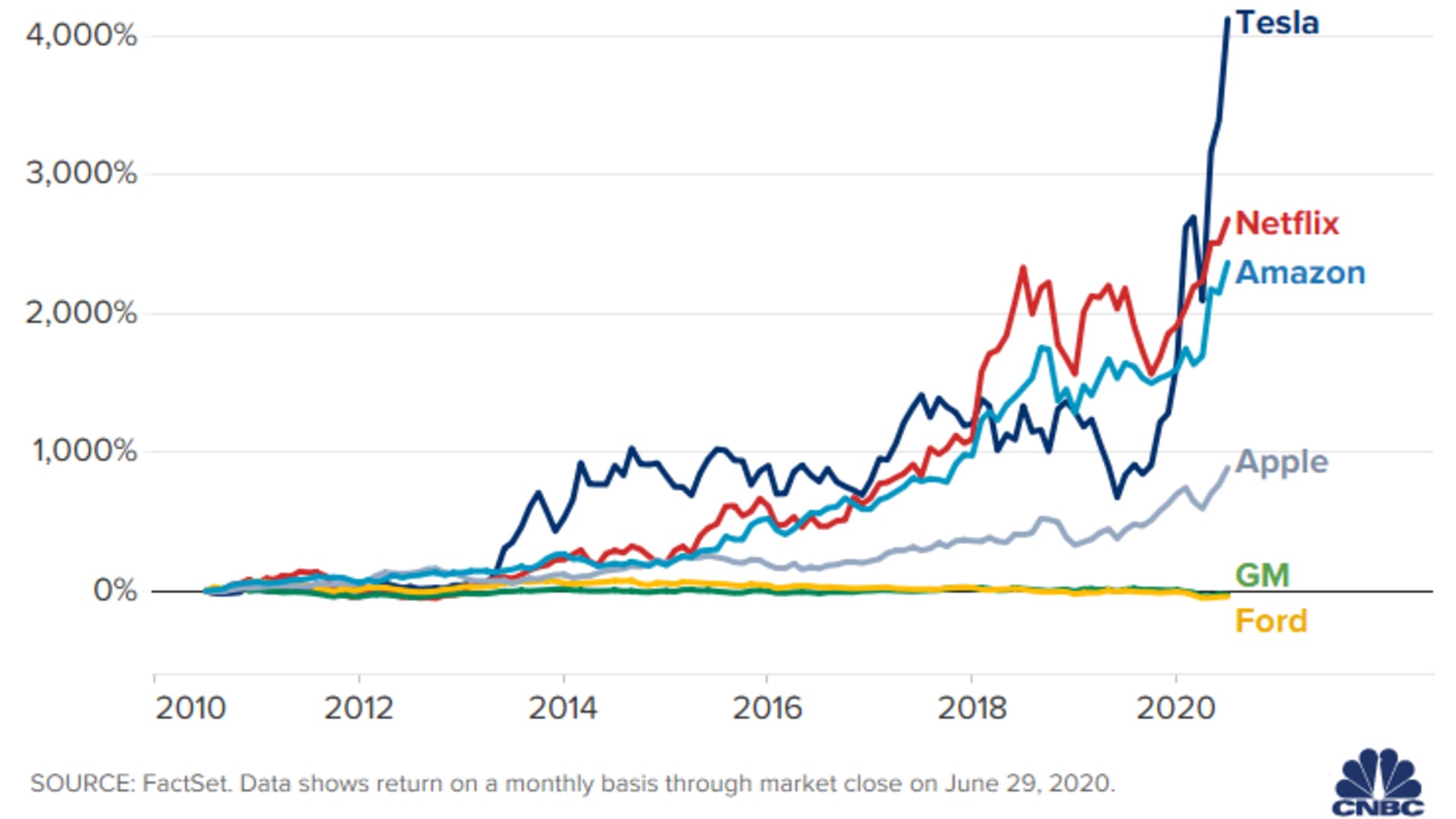

Understanding Tesla's historical stock performance provides valuable insights into its growth trajectory. Since its IPO, Tesla's stock has delivered remarkable returns, outpacing many traditional automakers.

Early Years: Building Momentum

In its early years, Tesla faced skepticism from the market, but its innovative products like the Model S and Model X helped build credibility. The stock price gradually increased as the company achieved key milestones.

Recent Growth: 2020 and Beyond

Tesla's stock price skyrocketed in 2020, fueled by strong financial results, global expansion, and increased demand for electric vehicles. The company's market capitalization surpassed that of major automakers, solidifying its position as a market leader.

Read also:Yasmeen Ghauris Husband A Glimpse Into Her Personal Life And Family

Factors Affecting Tesla Stock Price

Several factors influence Tesla's stock price, ranging from financial performance to external market conditions. Here are the key drivers:

Financial Performance

Tesla's quarterly earnings reports play a significant role in shaping its stock price. Revenue growth, profitability, and cash flow are closely monitored by investors.

Product Launches and Innovations

New product announcements, such as the Model Y and Cybertruck, often lead to spikes in Tesla's stock price. The company's commitment to innovation keeps investors optimistic about its future.

Global Expansion

Tesla's expansion into new markets, particularly in China and Europe, has been a major catalyst for its stock price growth. The company's ability to penetrate these markets demonstrates its global appeal.

Tesla Stock Market Analysis

A thorough analysis of Tesla's stock price involves examining technical indicators, market sentiment, and macroeconomic factors.

Technical Analysis

Traders use technical indicators such as moving averages, RSI, and MACD to predict Tesla's stock price movements. These tools help identify trends and potential entry or exit points.

Fundamental Analysis

Fundamental analysis focuses on Tesla's financial statements, competitive position, and growth prospects. Investors assess the company's revenue, earnings, and cash flow to determine its intrinsic value.

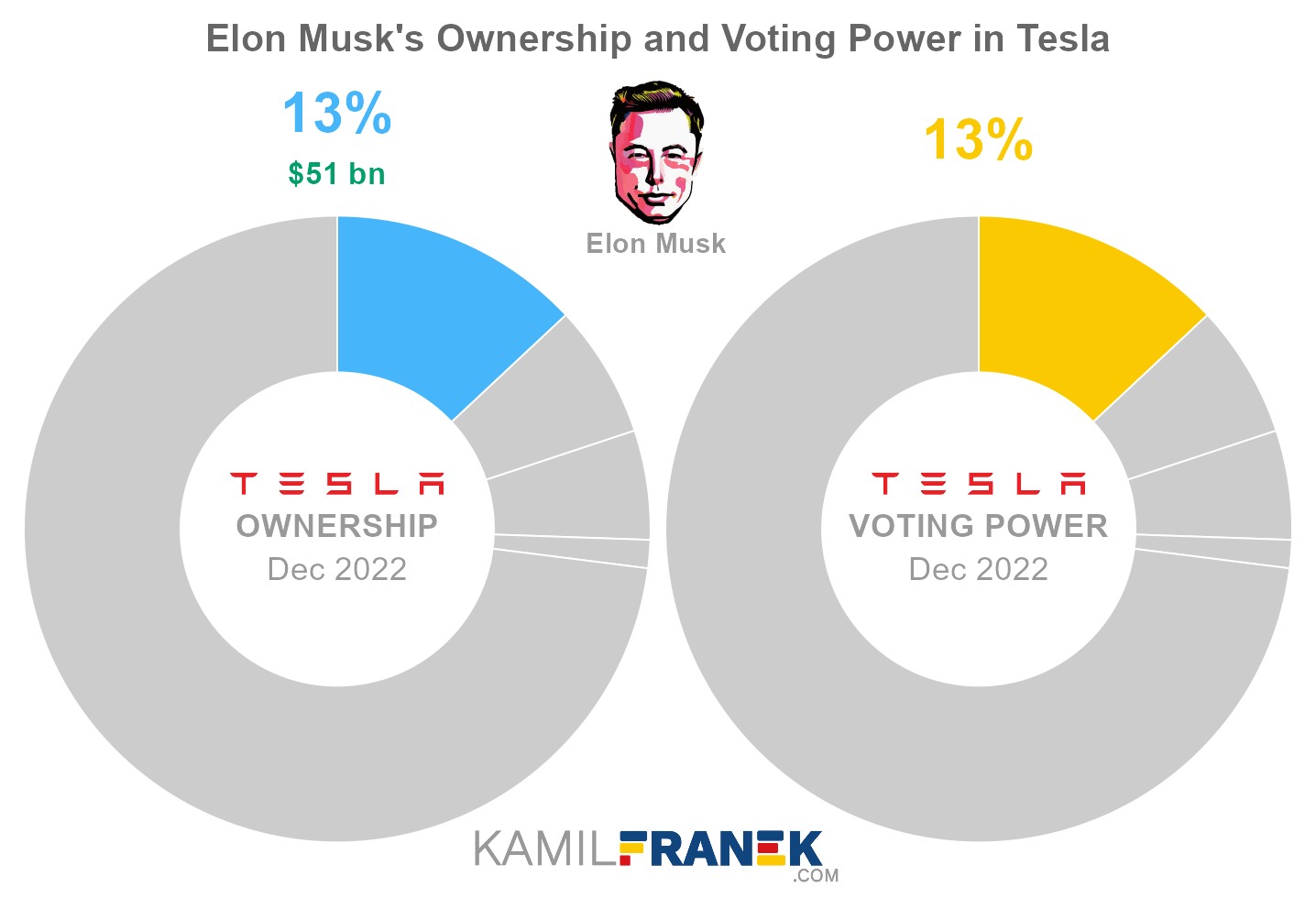

Market Sentiment

Social media and news outlets significantly influence Tesla's stock price. Positive sentiment from Tesla's CEO, Elon Musk, often leads to short-term price increases.

Long-Term Outlook for Tesla Stock

Tesla's long-term outlook remains positive, driven by its leadership in the electric vehicle market and commitment to renewable energy solutions.

Electric Vehicle Adoption

As governments worldwide push for cleaner transportation, the demand for electric vehicles is expected to grow exponentially. Tesla is well-positioned to capitalize on this trend, supporting its stock price.

Energy Solutions

Tesla's energy products, including solar panels and energy storage systems, contribute to its diversification strategy. These products enhance Tesla's value proposition and reduce reliance on automotive sales.

Investing in Tesla Stock

Investing in Tesla stock requires careful consideration of risk and reward. While the stock offers significant upside potential, it is also subject to volatility.

Risk Management

Investors should diversify their portfolios to mitigate the risks associated with Tesla stock. Setting stop-loss orders and position sizing are essential strategies for managing risk.

Long-Term vs Short-Term Investing

Long-term investors focus on Tesla's growth potential, while short-term traders capitalize on market fluctuations. Both approaches have their merits, depending on individual investment goals.

Tesla Stock Price Predictions

Analysts and experts provide varying predictions for Tesla's stock price. While some foresee continued growth, others warn of potential challenges.

Bullish Outlook

Bullish analysts cite Tesla's innovation, market leadership, and global expansion as reasons for optimism. They predict Tesla's stock price could reach new highs in the coming years.

Bearish Outlook

Bearish analysts highlight risks such as competition, regulatory challenges, and execution risks. They caution investors to remain vigilant and monitor market conditions closely.

Tesla Stock Price vs Competitors

Tesla's stock price outperforms many traditional automakers, reflecting its unique positioning in the market. Comparing Tesla to competitors like Ford, GM, and Rivian provides context for its valuation.

Market Capitalization

Tesla's market capitalization dwarfs that of its competitors, underscoring its dominance in the electric vehicle space. This disparity reflects investor confidence in Tesla's future prospects.

Revenue Growth

Tesla's revenue growth surpasses that of many established automakers, driven by its expanding product lineup and global presence. This growth contributes to Tesla's premium valuation.

Risks and Challenges for Tesla Stock

Despite its success, Tesla faces several risks and challenges that could impact its stock price.

Competition

Traditional automakers and emerging startups are investing heavily in electric vehicles, increasing competition for Tesla. This competition may affect Tesla's market share and profitability.

Supply Chain Issues

Global supply chain disruptions, particularly in semiconductor production, pose a threat to Tesla's operations. Addressing these challenges is crucial for maintaining stock price stability.

Regulatory Environment

Changes in government policies and regulations could impact Tesla's business model. Staying compliant with evolving regulations is essential for sustaining long-term growth.

Conclusion

Tesla stock price continues to captivate investors and analysts alike, reflecting the company's innovation and market leadership. Understanding the factors influencing Tesla's stock performance is essential for making informed investment decisions.

We encourage you to explore further resources and stay updated on Tesla's developments. Share your thoughts in the comments below or explore other articles on our site for more insights into the financial world. Remember, investing in Tesla stock requires careful consideration of risks and rewards. Stay informed and make decisions that align with your financial goals.